Monday, 14 March 2011

If you're still following Future of Mobile Broadband...

Monday, 24 January 2011

Redirecting you to the Wireless Noodle blog

Monday, 9 August 2010

No more here for a while...

Tuesday, 15 June 2010

Australia sees impressive improvement in MBB speeds

This degree of improvement is impressive indeed and reinforces that mobile broadband can be a realistic alternative to DSL, particularly for users with relatively modest speed requirements.

Thursday, 10 June 2010

AT&T and Verizon abandon unlimited mobile data - the only sensible move

Obviously there are some drawbacks to this approach. Users love unlimited plans as it takes away any fear, particularly of the dreaded overage fees. However, the availability of unlimited plans puts undue strain on the network as a result of small numbers of heavy users generating massive volumes of traffic. Last year I was in Finland and all the operators there were complaining about exactly this issue. They let the unlimited genie out of the bottle and were struggling with how to put it back in. But put it back they must.

Managing traffic growth by restricting unlimited plans is essential if MNOs are going to manage the rapidly declining revenue per GB that threatens to derail plans for deploying new network capacity. Let's face it, no-one's rolling out LTE do provide better voice coverage. It's all about data and if the MNOs can't maintain a reasonable rev/GB then regardless of LTE's benefits in terms of spectral efficiency, they won't be able to afford to deploy. Restoring a link between revenue and usage is essential.

Thursday, 4 March 2010

Coping with wireless traffic demand

I recently published an Insight article for Analysys Mason based on some of the research I was doing at Mobile World Congress. My focus this year was on wireless traffic growth and how MNOs could deal with it. Below are a brief summary of the findings. Full version here.

A major focus of Mobile World Congress (MWC) 2010 was the seemingly inexorable and exponential growth in wireless data traffic. This is exemplified by the growth in Vodafone’s European data traffic: a 300% increase over the last two years. There have been even more substantial localised spikes: O2 UK, for instance, experienced a twentyfold increase in data traffic during 2009, and Hong Kong’s CSL saw a fourteenfold increase in traffic in the nine months after the deployment of HSPA, in March 2009.

Given this trend, vendors at MWC outdid each other in predicting traffic growth over the next five years: Cisco claimed that global data traffic will increase by a factor of 39 between 2009 and 2014, while Ericsson predicted fiftyfold growth by 2015. NSN plumped for forecasting an equally round, but rather more ambitious, hundredfold rise. Analysys Mason is currently working on its own forecast of global traffic, which will be published in April. The consensus within the industry is that there will be substantial growth in demand for wireless traffic over the next five years.

A successful strategy for dealing with this exponential growth in wireless data traffic has four pillars, each of which is necessary, but is itself insufficient to deal with the demand.

- Spectrum: a scarce resource. Currently, MNOs rely on a relatively small piece of spectrum to provide data services. In Europe, for instance, 3G uses a total of 150MHz in the 2.1GHz band. Similar constraints apply in other regions. Large chunks of additional spectrum at 800MHz and 2.6GHz are soon to become available and MNOs are looking to refarm 900MHz spectrum to use for 3G. In the next five years in Europe, the total available spectrum for 3G and 4G will increase from 150MHz to 470MHz, which is a 200% increase in capacity. See here for more explanation.

- Technology choices: HSPA+, LTE, MIMO and beyond. The availability of capacity does not, of course, rest solely on what spectrum is obtainable. It also depends on the technology that is used. As MNOs upgrade to HSPA+ and LTE, they will be able to squeeze more capacity out of their spectrum. The addition of features such as MIMO and multiple carriers brings significant benefits. Compared with the existing 14.4Mbit/s HSPA that is fairly common in developed 3GPP markets today, LTE offers approximately three times the capacity (assuming the same amount of spectrum). For more, see here.

- In-building coverage: femtocell or repeater? Analysys Mason anticipates that by 2016, over 80% of global wireless data traffic will be generated indoors. It is critical to MNOs’ success that they offload this traffic from the wireless macro network. Today, much indoor usage, particularly that of PC-based mobile broadband, is already offloaded and MNOs must ensure that this trend continues. Evidence from Analysys Mason’s consumer survey shows that most mobile broadband usage takes place in the home and other recent analysis (our Comment article "What the Nordic markets can tell us about fixed-mobile broadband substitution" indicates that mobile broadband is becoming a true substitute for DSL. As in-building traffic increases, so will the requirement to offload it from the macro network. The femtocell is the most obvious technology to use to offload this traffic. Wi-Fi could achieve similar objectives, but its long-term success is in question because it uses unlicensed spectrum. Also, there are more-effective ways of delivering in-building capacity using solely the macro network. Delivering in-building traffic places up to three times as much strain on the network as the equivalent volume of outdoor traffic (see Analysys Mason Comment "Is indoor coverage good enough for mobile broadband?"). MNOs can significantly improve performance if they can make the provision of in-building bandwidth more closely resemble that of outdoor bandwidth. This can be achieved using repeaters, which can be strategically placed close to windows.

- Traffic, policy and subscriber management: making the users pay. The most important thing that MNOs can do to ensure the future profitability of their networks is effectively to manage their subscriber bases and the traffic that these generate. Figures vary, but MNOs are finding that, typically, 80% of wireless data traffic is generated by 5–10% of their subscribers. This is not a problem as long as those who are consuming the data are paying for it. This is often not the case, particularly where MNOs offer tariffs that include unmetered access. Operators that have chosen to offer unlimited plans are now regretting this. It is critical for future network upgrades that MNOs do not allow subscribers to consume bandwidth without generating commensurate revenue. If they are able to control this successfully, it will either reduce network load or ensure that their margin per gigabyte increases substantially. This will either lessen the need for expensive network upgrades or provide the cash to undertake them.

A combination of acquisition of new spectrum and deployment of LTE will increase network capacity to nine times what it is now. However, this will be expensive and it will not be sufficient to meet bandwidth demand. In order to meet the demand for data traffic cost-effectively in the next five years, MNOs must focus on halting the growth of in-building macro network traffic by using femtocell or repeater technology and on managing the demand for bandwidth by curbing the excesses of their heavy users.

Following up on this exercise, we'll be doing a lot of work looking at scenarios for coping with bandwidth demand and what strategies MNOs need to adopt. This will be based on a modelling exercise that looks at both the demand and supply elements of supporting wireless data traffic. The aim is to stitch the two sides together. Watch this space. Or drop me a line if you're interested.Thursday, 7 January 2010

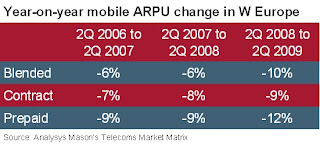

Recession drives down mobile ARPU

Based on a rough average across all the markets, blended ARPU fell 10% between Q2 2008 and Q2 2009, compared to a decline of just 6% in the previous 2 years. The most prominent decline has been in prepaid ARPU which fell 12% in the period, compared to just 9% in the previous 12 months. Contract saw a 9% fall, compared to 8% in the previous year.

So prepaid seems to have taken the brunt of the recession. In some ways that's unsurprising. Contract users are tied in with a guaranteed minimum spend for the duration of their contract. So any decline in ARPU will be slower to materialise. So it will be worth keeping an eye on over the next 12 months. The decline in prepaid is more immediate as users can instantly influence their spending and reduce it as necessary. They are also the most immediate recipients of any price discounts that operators choose to hand out.

This is all based on the marvellous data collected for Analysys Mason's Telecoms Market Matrix, the finest source of quarterly quantitative telco data that you can lay your hands on, covering both fixed and mobile markets in Western Europe and Central & Eastern Europe.