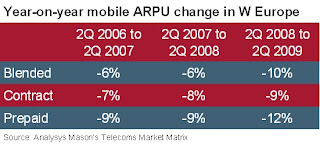

Based on a rough average across all the markets, blended ARPU fell 10% between Q2 2008 and Q2 2009, compared to a decline of just 6% in the previous 2 years. The most prominent decline has been in prepaid ARPU which fell 12% in the period, compared to just 9% in the previous 12 months. Contract saw a 9% fall, compared to 8% in the previous year.

So prepaid seems to have taken the brunt of the recession. In some ways that's unsurprising. Contract users are tied in with a guaranteed minimum spend for the duration of their contract. So any decline in ARPU will be slower to materialise. So it will be worth keeping an eye on over the next 12 months. The decline in prepaid is more immediate as users can instantly influence their spending and reduce it as necessary. They are also the most immediate recipients of any price discounts that operators choose to hand out.

This is all based on the marvellous data collected for Analysys Mason's Telecoms Market Matrix, the finest source of quarterly quantitative telco data that you can lay your hands on, covering both fixed and mobile markets in Western Europe and Central & Eastern Europe.

hi

ReplyDelete